How the Hell Is Kamala Gonna Pay for All This Shit?

Kamala wants to give you $50,000 for starting a business and $25,000 to buy your first home

And don’t get me started on free healthcare, which is probably next on the socialist agenda!

How is she going to pay for all this?

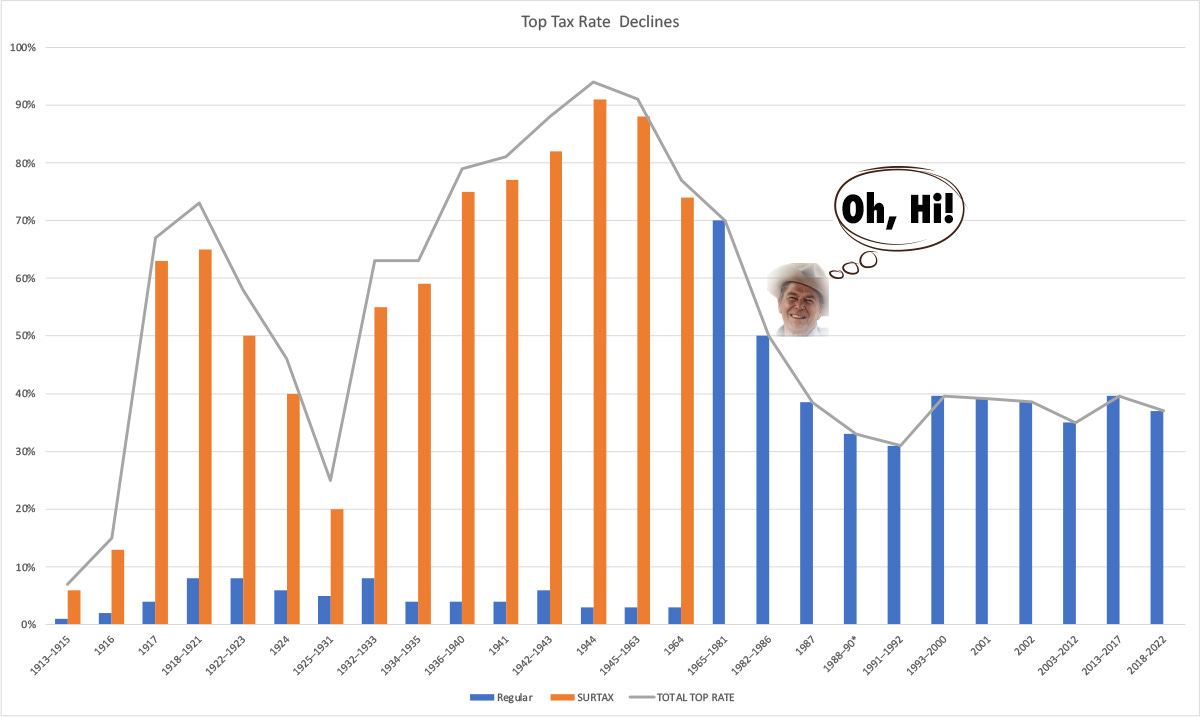

Well, to start with, let’s compare the highest tax rates in the United States from pre-Reagan days to now. The graph below displays the top income tax rates over the years, beginning in 1913. I added a small icon(ic) graphic to highlight an event when those top rates collapsed to modern levels.

Wait, who’s that thief in the cowboy hat lurking at the point where the top tax rates crater? Why, it’s no less than the legendary Robbin’ Hood for the Rich, whose calamitous and inequitable tax policies are still haunting us 44 years after his election. He’s the guy who popularized the concept, which still governs American tax policy, even under Democrats, that it’s okay to rob the poor to give to the rich.

The graph reveals a precipitous decline in top tax rates paid by Americans since the Reagan years.

I know it’s difficult to read the years at the bottom of the graph, but worry not, I’m here to guide you.

Other than a brief hiccup between 1925 and 1931 (cough — immediately preceding the Great Depression), the top tax rates of yore shepherded the country’s highest earners into contributing considerably more to society than they do today.

Then, when Reagan was elected, crash, boom, bah. The rates paid by the nation’s top earners collapsed to nearly their current rate.

In 2021 that top rate was 37% based on an income of $628,301. This year the top rate is based on $609,350 for single filers. The 2021 rate of 37% represented a drop from 94(!)% in 1944. That’s a little extreme even for an old burned-out socialist like me, but hey, there was a war to be won.

The 1944 peak was also notable because it came at a time when the US was close to becoming a Democratic Socialist state in the mold of modern European states. The New Deal, along with the Works Progress Administration, which was a jobs program financed by the government that touched almost every American community, instilled into Americans the notion that big government was their friend.

Underneath the hood, a strong, if sometimes corrupt, capitalist engine hummed, cranking out tanks, planes, and bombs at prodigious rates.

That said, 94% is a bit extreme. I don’t believe that people making $600,000 should be left with a tiny fraction of that.

If anything, I think we should raise the income level that triggers the top rates, since $600,000 verges on becoming a middle-income bracket in some parts of the country like California. But my point here isn’t to debate those specifics.

Instead, I’d like you to focus on the percentage change in top income tax rates when Reagan took office and passed his first round of tax cuts. They’ve fallen or held steady ever since. The initial cuts so severely damaged the American welfare delivery system that Reagan’s successor, former CIA director George Bush, the proud poppa of Dubya (aka, the Destroyer of the Middle East), promised a “kinder, gentler nation.”

He didn’t deliver.

Bill Clinton, who followed Bush, was elected partly because he was willing to become subservient to the general proposition that big government was a bad thing. He also almost single-handedly converted the Democratic Party into a massive lobby machine for corporations. But that’s a problem we’ll have to deal with after the soulless master of mendacity is finally behind bars.

Americans mostly still believe that big government should be avoided at almost any cost. Republicans have done a bang-up job convincing a gullible public that the government is full of waste and incompetent bureaucrats.

In some cases, it is. But, believe it or not, some companies are run as badly as the Veterans Administration. Take Boeing, which plays a vital role in the American economy and can’t even keep the doors to its jets fastened securely in flight. When Boeing fucks up, planes go down, people die, and sometimes enough hell is raised by the press and public for heads to roll.

But, generally, corporate incompetence, and worse, malfeasance, is obfuscated and sanitized. Boars Head, a purveyor of gross, rolled-up meats designed to cause obesity and diabetes, had to shut down a plant because of a Listeria outbreak.

The outbreak occurred partly because the Trump administration had earlier agreed to allow the company to increase the speed of its production line without oversight, and partly because Boars Head is run by incompetent, or worse, uncaring managers who don’t care if people die until the press finds out.

But other companies also crank out disgusting, rolled-up meats that make people sick, but nobody shuts them down. That’s because a few sick kids rolling around on the bathroom floor after wretching doesn’t make headlines.

Oil companies routinely poison our waters and have triggered a climate crisis, purposely, according to internal Exxon memos, but they don’t get the same treatment as big government because the American people have been brainwashed into thinking Minnie Walker of Long Beach, Mississippi is using her food stamps to purchase one too many bags of candy for her kids instead of the proper amount of veggies and fruit.

No matter that companies routinely leak oil sludge onto Long Beach’s shoreline near Minnie’s home with nary a harsh whisper from the press or local politicians, who love big oil’s big money. Sometimes, a major event like the Deepwater Horizon catastrophe will send gulf beaches reeling for decades. But the voters there keep voting red, oblivious to the massive cancer platforms near their shores.

Eventually, lawsuits enter the picture and some companies unhappily start sharing some of the cleanup costs, but none of that happens until long after the federal government has expended billions of taxpayer dollars on emergency operations.

Meanwhile, train tankers full of noxious poisons blow up and clear out entire towns. The litany of corporate villainy could run a Substack, and probably does somewhere. Feel free to drop a link or three in the comments.

Beginning with Reagans’s presidency, the phrase “Tax and spend liberals” became part of the generic American lexicon instead of the more accurate, “Tax and pay for shit.” When a Norfolk Southern train derailment taunted East Palestine, Ohio with hazardous materials, tax dollars were needed for cleanup. The government had to immediately pay for the shitstorm Norfolk Southern created because it takes years for lawsuits to be settled.

Whatever was spent wasn’t enough. The wreckage and a controlled burn afterward spread pollution across 16 states and 540,000 square miles. More than 100 million residents were impacted by the train wreck. By my math, that’s one-third of the population. Chemicals like vinyl chloride, ethyl acrylate and isobutylene were on the train’s manifest.

The train was a chemical bomb shooting across the country. The rail bomb exploded in a part of Ohio that is almost certain to vote for Donald Trump in large numbers. That’s how effective Republican tax and spend propaganda has become, even though Donald Trump increased the national debt by record amounts when he was in office.

Democrats have been unable to nudge the corporate tax rate up from its current 21% to the 35% it was before Trump was elected, despite the environmental toll companies leave in the wake of doing business. Wildfires burn across the West and Canada, but the companies that cause them have seen their tax rates cut anyway, cutting off the funds needed to help pay for cleaning up their pollution.

All these tax rate cuts don’t even begin to cover multibillionaires, who have devised so many ways of avoiding taxes that it would take several Substacks to cover them all.

Multibillionaires are proud of their tax evasion prowess. One of them even bragged about the skill while running for president when he was still relatively coherent.

The myth of the exploding U.S. national debt

There’s a myth that Democrats run up the debt (and deficits), and Republicans do not. The opposite is mostly true because Republicans keep cutting taxes without cutting the services those taxes pay for. Part of the reason they don’t cut services is that further cuts will be political suicide, but it’s also because, after Clinton left the Oval Office, Democrats in Congress have done a good job of kneecapping any further serious attempts to do so.

Social welfare has been gutted so thoroughly since the Reagan years that cutting it any further will make middle-class voters irate.

The cuts Reagan initiated and that Clinton agreed to extend did little to dent the national debt, anyway. Taking away childcare and other subsidies for poor people, especially young single mothers, was mostly a showpiece whereby Clinton could point to the American flag on his lapel and proclaim, “See, I’m one of you.”

Americans cheered.

However, the cuts had virtually no impact on the national debt because social welfare is a tiny portion of the budget.

If you flick a flake of pie crust off an apple pie, you’re not changing the structure of the pie.

The only way to do that is to take out a slice. Republicans would like to do that by privatizing Social Security. You might think that’s unlikely until you look at all the other things they’ve been working on for 40 years and managed to do, like killing Roe v. Wade. Take a look at Project 2025 (pdf) if you want a truly dystopian vision of their intent.

The Republican “concern” about the national debt is all for show, anyway. Trump ran up the debt at a record pace with little objection from Republicans in Congress.

As ProPublica’s Allan Sloan and Cezary Podkul wrote shortly after Trump lost the 2020 election, the national debt rose by almost $7.8 trillion during Trump’s term in office. That’s trillion. With a T.

I’ll quote Sloan and Podkul here:

That’s nearly twice as much as what Americans owe on student loans, car loans, credit cards and every other type of debt other than mortgages, combined, according to data from the Federal Reserve Bank of New York. It amounts to about $23,500 in new federal debt for every person in the country.

Much of this debt was accumulated before the pandemic, which ushered in some additional deficit spending that almost everyone agreed was necessary, but, despite what Republicans might tell you, wasn’t the driving force behind the new debt load.

The main culprit to Trump’s national debt? His tax cuts, which slashed the corporate tax rate to 21% from 35%. This provided a temporary stimulus in spending by the companies that didn’t keep the savings (which, by some estimates, was most of them through the form of stock buybacks). It also accounted for 4% of the gross domestic product in 2018 and 4.6% in 2019.

This kind of debt-to-GDP ratio is inflationary, as Biden found out when he inherited the ratio and the serious supply chain issues Trump left behind in the wake of the pandemic.

It’s the third-largest rise in the national debt of any presidential term. The other two were also overseen by Republicans, but one of those would be a Democrat today: Abe Lincoln, who had to bankrupt the country to fight off slave-holding maniacs (the same kind of people who today are taunting Haitians in Springfield, Ohio).

George W. Bush is the other record-holder. He also had a war to pay for — one of the biggest blunders in foreign policy history that we are also still paying for because it was charged on the federal credit card.

The illegal, and immoral, invasion of Iraq gave birth to ISIS and a new generation of terrorists. It indirectly helped fuel other extremists in the Middle East, such as Hamas and Hezbollah. It was expensive in both monetary costs and human lives. It empowered Iran, the funder of all the Mideast terrorist organizations that start with the letter “H.”

It is not a stretch to say that Bush’s debt-fueled war not only killed around half a million innocent Iraqis but indirectly helped kill 40,000 Gazans, too. Without an American military run amok, the Middle East would not be the massive training camp for terrorists that it is today.

(Aren’t you glad Cheney is on our side now?)

And Congress never authorized a way to pay for all of that. So the U.S. charged it on the credit card that we’re still paying interest on.

Trump’s debt, then, was the largest addition to America’s national debt in history that wasn’t necessitated by some kind of war, immoral or otherwise.

As Allan Sloan and Cezary Podkul for ProPublica wrote shortly after Trump lost the 2020 election, the national debt rose by almost $7.8 trillion during Trump’s term in office.

This is an important point when hypocritical Republicans try to argue with you about the government helping first-time homeowners.

The argument is almost aways, “We can’t afford it.”

As Obama used to say when he dreamed of purple states, “Yes, we can.”

But only if we roll back the tax cuts that Trump put into place and adjust the tax rates to look more like they did in the 1970s.

Rolling back corporate tax cuts will only make it a little easier to cover the massive cleanup costs that corporations leave around for us to deal with. It’s not going to pay for those first-time buyer home loans or for the small business grants Kamala Harris is gunning for.

What will?

In addition to pushing tax rates back up for the highest earners, we’ll need to think out of the box. We’ll need to look at things like raising taxes on luxury goods (currently 10%). Want to buy a yacht? Fine, but be prepared to fork over 25% (or whatever) of the cost to the federal government by way of sales tax so that someone else has an opportunity to buy one down the line, too.

You may think it’s cool to purchase that 4 million dollar painting, but I hope you are also happy to brag about how its 30% sales tax helped Johnny Malone in Chester, Pennsylvania start a motor home park.

Want that unique baseball card or stamp with an upside airplane? Fork over some money to the people, too.

I’m sure that you or your wife or husband or even kid deserve all that expensive jewelry. Won’t it be satisfying knowing that the 40% sales tax on that beautiful necklace is helping Sam Klusky start his custom body auto shop?

Conservatives will argue such tax increases will suppress sales of luxury goods. Nothing will suppress them short of a mass extinction of wealthy people.

As for top income tax rates, I don’t have an answer. We need to pick a number, though. Is it $5 million a year after the first million? I don’t know. I’ll let y’all hash that out. But we need a number that acts as a line in the sand to which we say, “Up goes your income tax rate.”

Many economists, like Nobel winner Paul Krugman, will even tell us to cool our jets about the national debt in general. But if we do want to start picking at it, the place to begin is the billionaires who don’t pay any taxes.

As a nation, we need to stop talking about how programs that break the inequality tearing the nation in half with a permanent separation of haves and have-nots are too expensive.

The divide that we all are exhausted from, the fist-raising, the racism, the shouting, all of that goes away if we expand the pie in such a way that all Americans seem to be sharing it fairly. Strife and division will organically fade. Trump did not arise in a vacuum. He appeared as direct symptom of a fissure created by historic levels of inequality.

We’ll need to raise some taxes to fix this.

But it’s not Tax and Spend. It’s Tax and Fix.

I say go back to the tax rate that JFK had and the rich didn’t go broke. They were still wealthy. All those tax cuts and tax breaks for billionaires and corporations, only created more wealth for billionaires and the corporations. We don’t need more rich people. The one percenters should pay the fair share. Math is a wonderful thing. The universal language.

I have always found the comment “We can’t afford it.” to be ludicrous. Of course we can and must or our future generations will pay a steep price to simply survive.

Our capitalist culture has created a ‘must have’ society. Getting rid of stuff consumes us. Media celebrates the rich. We have a lot to change in order to learn to contribute to a better society. Paying our share and learning the value of it is a worthwhile and necessary place to start.